Household loans from banks increased by 5.7 trillion won last month, maintaining a high growth rate, but the pace slowed significantly compared to the previous month.

According to the "Financial Market Trends" report released by the Bank of Korea on the 11th, the balance of household loans from deposit banks at the end of September was 1,135.7 trillion won, an increase of 5.7 trillion won from the end of August.

This marks the sixth consecutive month of growth since April of this year, but the increase was 38.7% lower than in August.

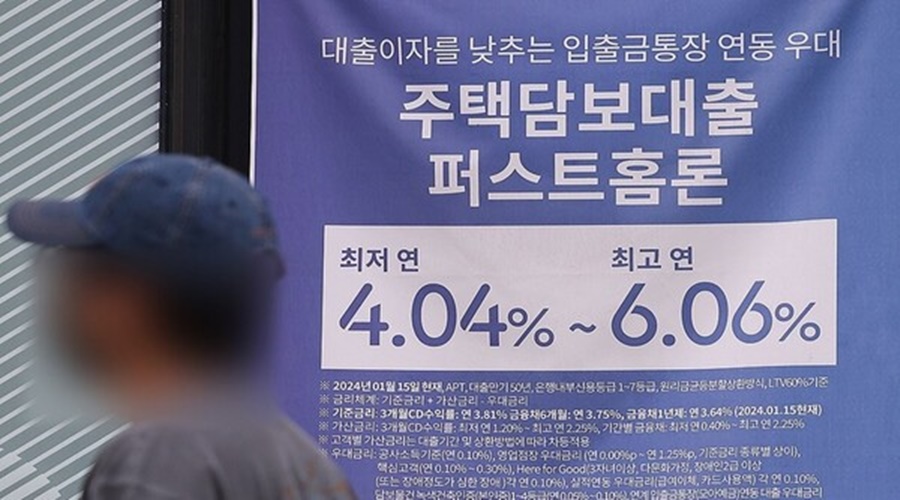

The main component of household loans, mortgage loans, increased by 6.2 trillion won, while other loans, such as credit loans, decreased by 500 billion won.

Although the increase in mortgage loans slowed compared to August, it remains at a high level.

A Bank of Korea official explained, "The slowdown in mortgage loan growth is the result of a combination of strengthened government policies and seasonal factors." The official also noted that temporary factors such as pre-demand in August and the Chuseok holiday also had an impact.

Meanwhile, according to the overall household loan trends in the financial sector announced by the financial authorities, total household loans across all financial sectors, including banks and secondary financial institutions, increased by 5.2 trillion won in September.

This is a sharp decline from the 9.7 trillion won increase in August. In particular, loans from secondary financial institutions decreased by 500 billion won.

A financial authority official stated, "Although the pace of household debt growth has slowed, it is still necessary to remain vigilant and manage the situation carefully."

Corporate loans also increased by 4.3 trillion won in September, slowing down from the 7.2 trillion won increase in the previous month. This was mainly due to an increase of 3.5 trillion won in loans to small and medium-sized enterprises, while loans to large enterprises increased by only 800 billion won.

Additionally, the balance of deposits in deposit banks stood at 2,390.8 trillion won, an increase of 18.9 trillion won, driven by corporate capital inflows and banks' active efforts to attract deposits.

https://www.sankyungtoday.com/news/articleView.html?idxno=48700

Household loans increased by 5.7 trillion won in September, but the growth slowed compared to the previous month.

Household loans from banks increased by 5.7 trillion won last month, maintaining a high growth rate, but the pace slowed significantly compared to the previous

www.sankyungtoday.com